Capital On Ramp Program (CORP) Pilot

Simplifying Loans for Wayne County Small Business Owners

What is CORP?

The Capital on Ramp Program (CORP) is designed to make the process of applying for small business loans simple and accessible. We understand that traditional loan processes can be challenging, especially for small business owners from underserved communities. CORP aims to clear these hurdles, providing an easier path to the funding small business owners need to grow and thrive. This is a way of getting a loan if you don’t have financial statements and projections.

Why We’re Doing This

Access to capital is crucial for small businesses, but many entrepreneurs face barriers, especially those from underserved communities. These barriers can include complicated financial jargon, technical documentation, and a lack of trust in financial institutions. CORP was created to address these issues, offering a straightforward application process and support to help you understand and manage your finances better. Our goal is to empower business owners and create a more inclusive financial environment.

Capital, Lenders, and Payment Terms

CORP offers loans of up to $35,000 for small businesses in Wayne County, Michigan that have been operational for at least two years. If you have a strong business, but you lack financial statements, projections or a written business plan, this program is for you.

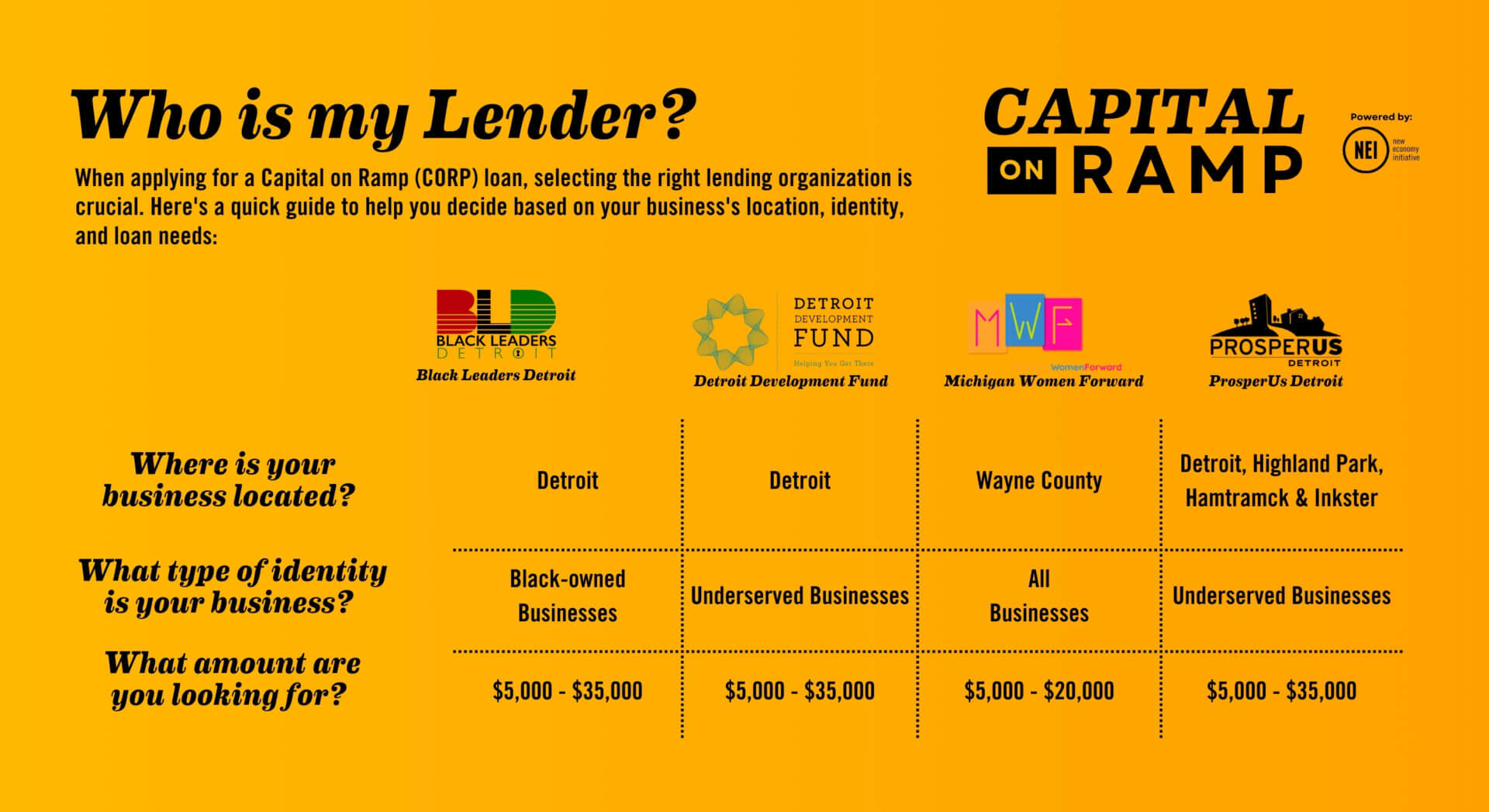

The program is currently in its pilot phase and is available through four trusted lenders:

- Black Leaders Detroit: Contact Larenz Studavent at larenz@blackleadersdetroit.org

- Detroit Development Fund: Contact Erin Grant at egrant@detroitdevelopmentfund.com

- Michigan Women Forward: Contact Tanesia Greer at tgreer@miwf.org

- ProsperUs Detroit: Contact Emily Sioma at esioma@prosperusdetroit.org

Once your loan is approved, you’ll work closely with your lender and a team of experts to ensure your business’s long-term financial health. CORP offers valuable technical assistance through our partners listed below. These experts provide coaching, standardized tools, and education to help you better understand your finances, manage your business finances effectively, and prepare for future growth.

Eligibility

To qualify for a CORP loan, your business must meet the following criteria:

- Located in Wayne County, MI

- In operation for at least two years

- Seeking a loan of up to $35,000

- Willing to participate in coaching and accounting support with free consultants (upon approval)

FAQs

Q: What is the maximum loan amount available?

A: Participating CORP lenders offers loans of up to $35,000.

Q: Who can apply for a CORP loan?

A: Any small business in Wayne County, MI that has been operational for at least two years is eligible. If you are interested in engaging in a long-term program that helps create sustainable cash management for your business this is for you!

Q: What support is available to help me with the application?

A: We provide written and video guides to help you through the application process. The participating lenders also have people available to support you as you apply.

Q: How long does the application process take?

A: The timeline can vary, but our streamlined application process is designed to be quick and efficient. You should plan on spending some time on completing the application thoroughly. Once your application is submitted, it will be reviewed by your chosen lender as their internal processes allow.

Q: Can I get help managing my business finances after receiving a loan?

A: Yes, CORP includes coaching and educational resources to help you manage your business finances and plan for future growth. If you are approved by your lender, you will then enroll in the technical assistance program. Experts will teach you the foundations of managing your cashflow so that you can do it effectively into the future and hopefully have a strong, sustainable business and access future capital as needed.

Q: How do I know which lender is right for me?

A: All of our lenders specialize in serving small business owners, particularly those who have been underserved by traditional financing. Take a look at the lender chart above. If you meet the criteria for all of them, give one a try! If you are not a fit for any reason, they can refer you to a different lender.

For more information or specific questions, please email us at NEIcommunications@cfsem.org. We’re here to help you succeed!